INDIANA FISCAL POLICY INSTITUTE |

RECENT PUBLICATIONS

2024

2024 Legislative Session Wrap-Up

2024 Legislative Session - Short Session Ends With Focus on Workforce Development, Education. Fiscal Issues On Hold Until 2025 - The Indiana General Assembly adjourned the “short” session on the evening Friday, March 8, 2024. While the session was labeled as short, that does not mean it was uneventful. A total of 756 bills and resolutions were introduced. In the final analysis, only 172 were passed and sent to Governor Holcomb for his signature. That is still a fair amount of legislation to be passed in a short ten weeks. For his part, the Governor only vetoed one bill, an education bill containing anti-discrimination language. On the tax side, only minor tweaks to local income taxes and property taxes were passed, most making little discernable impact. Several local food and beverage and Innkeepers’ taxes were approved, as well as administrative bills from the Department of Local Government Finance and the State Board of Accounts. These bills will certainly impact local government finance officers, but will be little noticed outside of fiscal experts. Read more here.

HEA 1002 (2023) - A New Hoosier Education Model

A Brief on the Opportunities and Challenges Around this New Uncharted Model for Education - In 2023, Indiana passed House Enrolled Act 1002. Legislators in support of the bill touted it as an opportunity to “reinvent high school” in Indiana by melding youth apprenticeships and work-based-learning opportunities with a school choice funding mechanism. As Indiana, like many states, continues to battle a growing labor shortage, building a talent pipeline in high school is a strategy that many states are embracing. This brief is the first of a series on Indiana’s emerging commitment to youth talent development and how it intersects with the growing school choice movement and interest in youth apprenticeship and work-based-learning in the Hoosier state. The brief touches on some of the barriers to the success of the program, and how those might be addressed in the years to come. Read more here.

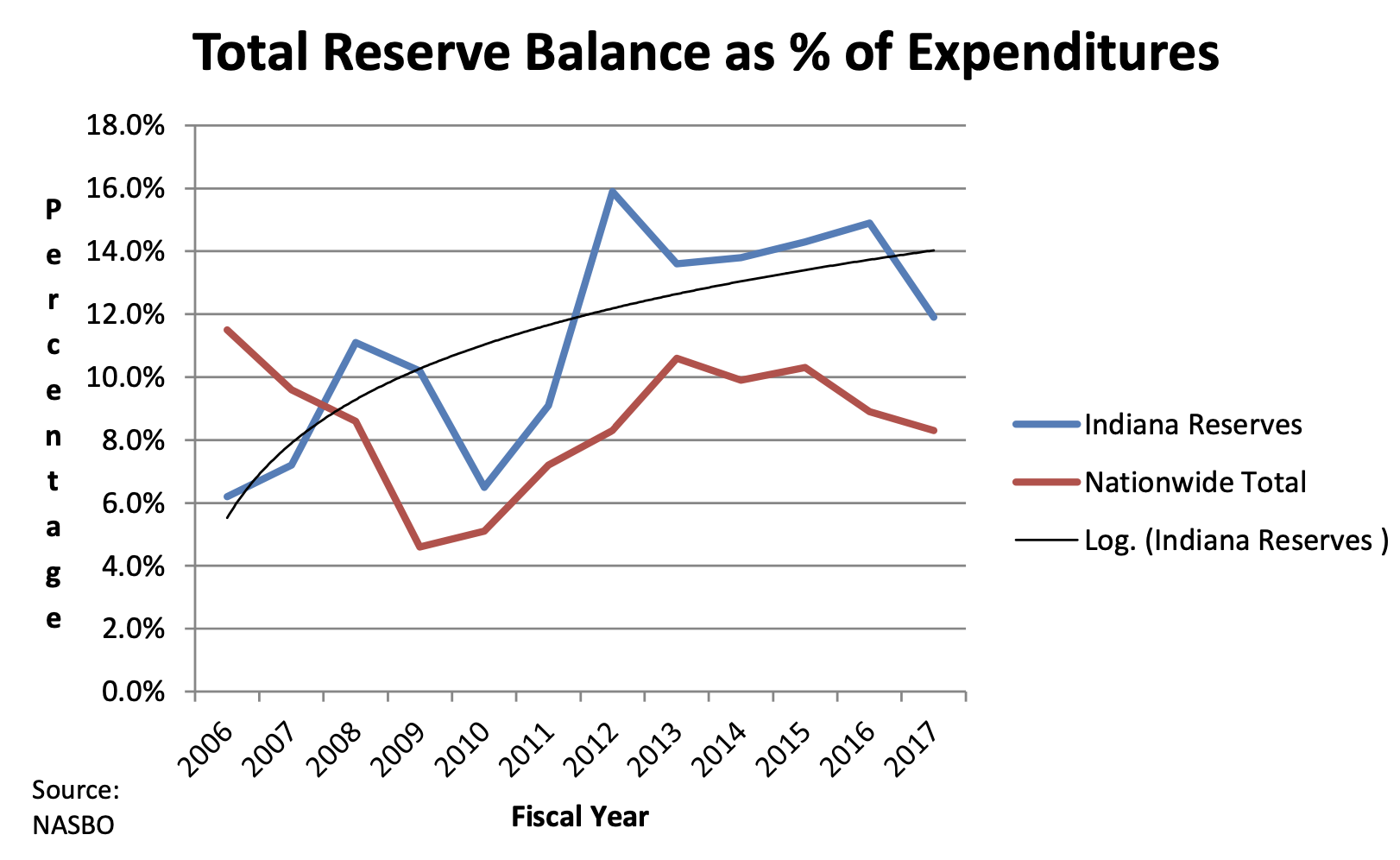

Pre-Legislative Session Fiscal Brief

Starting Session with a $1.5 Billion “Surprise”, Indiana Dips Below 10% Reserve for First Time Since Pandemic - The Indiana General Assembly returns next week on January 8, 2024, for a “Short Session”. Historically short sessions do not include the development of a traditional state budget, but there are fiscal issues that arise. This year, there are a few complications, laid bare in last month’s revenue forecast presentation to the State Budget Committee, that fiscal leaders will be forced to discuss. These include an unexpected overspend of $1 billion in Medicaid spread over state Fiscal Years (FY) 23-25 and a revised revenue forecast that reduced anticipated revenue collection by $500 million – these two factors combined to drain quite a bit of Indiana’s state reserves. Read more here.

2023

IFPI Interim Study Committee Wrap-Up

2023 Legislative Interim Study Committee Wrap-Up - As the Indiana General Assembly prepares for a new 2024 legislative session, they are wrapping up the work that was done this Summer and Fall vis a vis interim study committees. Each year, these committees study a wide variety of topics, often making recommendations for legislation to be considered by the full General Assembly to take up when it is next back in session. This year was no exception, with several fiscal policy relevant committees meeting and weighing in on important public policy issues. Read more here.

IFPI Hoosier Talent Snapshot

2023 Hoosier Talent Snapshot - Indiana's consistently tight labor market continues to be one of the primary challenges for Hoosier policy makers. The IFPI 2023 Hoosier Talent Snapshot is a primer for those who need more information on the challenges to building a talent pipeline, as well as potential opportunities to overcome barriers to work. Read more here.

IFPI FY Closeout Report

FY 2023 Close-Out Report - Back to Baseline - The State of Indiana closed the books on the fiscal year on June 30, 2023. On July 13th, fiscal leaders announced the state of Indiana’s balance sheet. Overall, increased consumer spending that spiked revenues in 2022 returned to baseline – Indiana raised $21.6 billion in revenues in the fiscal year, which is 0.7% over revenues for the previous year. Spending totaled $18 billion, an increase of 2.4% over the previous year. This normalization of revenues brings Indiana back within a typical (pre-Covid) range. The surplus of $2.9 billion is also more in line with historic averages. Read more here.

IFPI Legislative Recap

Indiana's 2023 Legislative Session - A Brief Summary of a Session Long on Fiscal Impact - On April 28, 2023, Indiana passed a balanced $44.6 billion biennial budget that maintains healthy fiscal reserves, pays down pension debt, increases K-12 funding, and accelerates already planned decreases in the state's individual income tax rate. Other bills that impact Indiana's fiscal health also passed this Session. A high-level summary of the most pertinent legislation is outlined here.

2022

Inflation and Indiana's Fiscal Outlook

A Discussion of Current Conditions & Potential Challenges

On March 31st, the U.S. Bureau of Economic Analysis announced the latest Personal Consumption Expenditures (PCE) Price Index. The PCE measures inflation by an analysis of business inventories (as compared to the Consumer Price Index), as is the Federal Reserve’s preferred barometer for guiding inflation policy adjustments. The PCE Index has hit a forty-year high, with a 6.4% annualized rate through February that doesn’t capture the spike in gasoline prices in the wake of Russia’s invasion of Ukraine.

IFPI 2022 Legislative Review: A short Session Long on Fiscal Impact

The Indiana General Assembly’s 2022 short session was long on major issues – and fiscal implications – in its ten-week sprint from the opening gavel to adjournment well ahead of schedule in the early hours of March 9th.

This summary will discuss:

The details of HB1002, the tax cut package that makes a $6.6 billion cumulative impact by FY2031 (pages 1-2); The potential implications of tax reductions for future budgets (page 2), including K-12 spending (page 3); and

The balance of Indiana’s tax code heading into the 2030s – are we cutting our way into overreliance on the sales tax? (pages 3-4)

From individual to business taxpayers, a summary of the personal property tax debate (page 5);

How the legislature added to the state’s economic development toolkit (and the influence of Ohio’s Intel win) (pages 6-7);

And a summary of other key legislation impacting state and local finances (page 8).

2021

Previewing Indiana's Revenue Forecast & 2022 Tax Relief Prospects

The Big Short: State Revenues, Tax Relief and the 2022 Legislative Session On Thursday, the State Budget Committee will receive the annual forecast of Indiana general fund revenues, updating April’s projections for tax collections supporting the FY2022-2023 biennial budget. The forecast could also be a prelude to tax relief in next year’s session of the General Assembly: While a non-budget short session typically focuses on issues without significant fiscal impact, these are far from ‘normal’ times for state finances. This brief provides a refresher on the current revenue climate leading into the December 16th Budget Committee presentation and a discussion of tax plans that have been floated publicly by legislative leaders. |

Indiana's Local Income Tax: Distributions and Balances in Recession and Expansion

Dr. Larry DeBoer - Professor Emeritus of Agricultural Economics, Purdue University

How does Indiana fund local government – police and fire protection, street repairs and stormwater systems, the essential services and routine amenities closest to the daily lives of Hoosiers, delivered by counties, municipalities and other local taxing units like townships and library districts?

Fiscal Year 2021 Closeout Report

How high is Indiana’s post-COVID revenue bounce?

Last July, the COVID crisis had crushed Indiana’s Fiscal Year 2020 revenues by more than a billion dollars, state agencies had cut or cancelled nearly $700 million in planned spending ($373 million in reversions, plus the reversal of $291 million in accelerated payments for capital projects), and budget officials were bracing for the prospect of worse to come.

What a difference a year makes. On July 14, Indiana’s FY2021 Fiscal Year Close-Out report was released, chronicling a remarkable rebound from depths of the pandemic, with state revenues soaring to overwhelm statutory limits on the size of Indiana’s surplus and give Hoosiers an automatic income tax credit in 2022.

COVID and Local Food & Beverage Taxes

IFPI LEGISLATIVE SESSION REPORTS

2020State Revenue Forecast: Modest Hope After the Hardships of 2020We’re all eager to say goodbye to 2020 in two weeks. But there’s six more months before we can turn the page to a new fiscal year, and the next state budget cycle – with plenty of work in the interim. Last week marked an important milestone in the process, as the State Budget Committee received a revenue forecast that projected modest growth in FY2022-2023: $34.95 billion in anticipated general fund revenues, versus $33.1 billion (estimated) for the current COVID-ravaged biennium. Even though observers were socially distanced or watching virtually, you could almost hear the collective sigh – one part relief, one part resignation. Even though the forecast was “better than expected,” it certainly wasn’t robust enough to avoid tough choices and some difficult negotiations over the next budget. FY2020 Close-Out Commentary: When It Rains, It PoursFY2020 Summary:

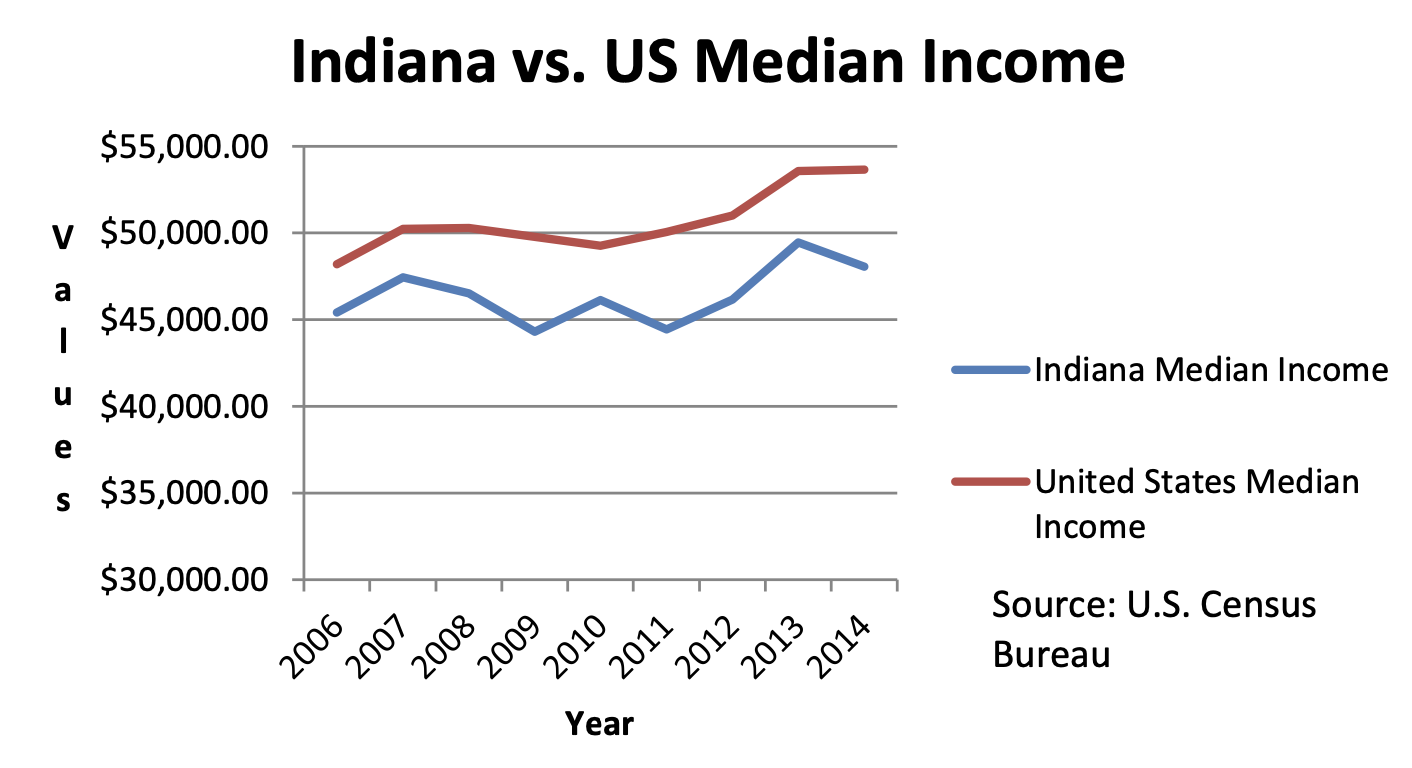

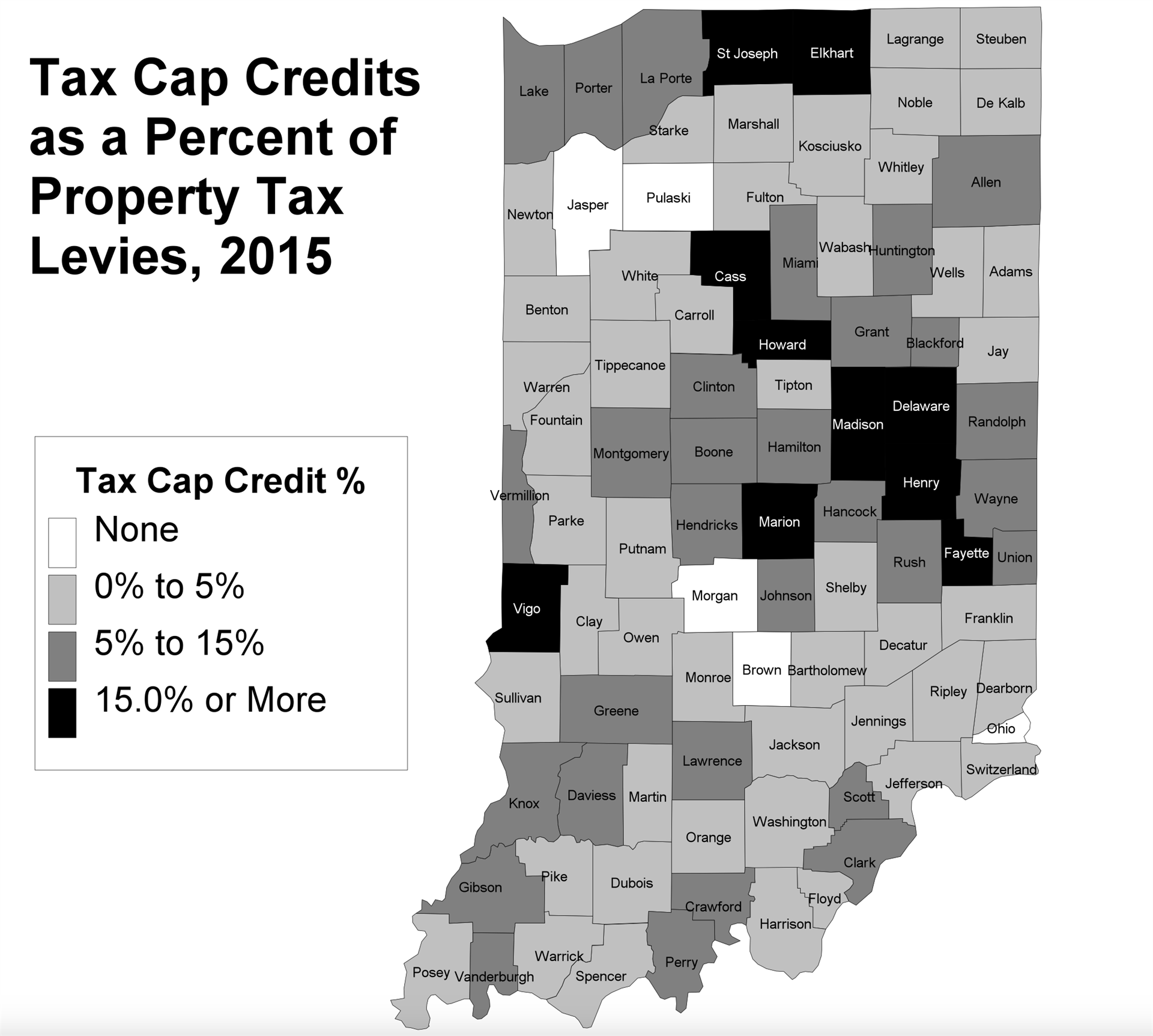

Calm before the Storm: The 2020 Indiana General Assembly in ReviewFirst, acknowledging the obvious: The world has changed in the week since the close of the 2020 session of the Indiana General Assembly. The human toll of the COVID-19 pandemic is paramount, as Hoosiers join the world in facing a public health emergency unlike any in more than a century. But for our purposes, let’s begin with a few words framing the potential fiscal consequences. Capacity-Cost Indexes of Indiana Local Governments - 2002 & 2018, 2020Even before COVID-19 reached Indiana to create widespread economic disruption and decline, local governments in the places where most Hoosiers live and work had been grappling with growing budgetary pressure even during the decade of recovery from the Great Recession of 2008-2009. In 2019, the Indiana Fiscal Policy Institute (IFPI) asked Dr. Larry DeBoer of Purdue University to revisit and expand an earlier analysis of local government fiscal climate. This resulting study, “Capacity-Cost Indexes for Indiana Local Governments – 2002 & 2018,” analyzes the economic, demographic and policy changes contributing to a divergent pattern of revenue capacity and service costs across urban, rural and mixed (suburban and industrial) communities. Professor DeBoer details how fiscal stress has increased in urban counties, as revenue potential also fails to keep pace with costs in many of the state’s fastest-growing areas. He explores the negative effects of manufacturing losses on industrial counties that have failed to diversify, and the revenue stability that agricultural assessment and tax policies have brought to rural counties since 2002. As the COVID recession reduces revenue capacity statewide, we believe the report also acts as a roadmap to areas likely to be hardest-hit by a sharp downturn, accelerating the longer-term challenges of a tax base limited by a combination of policy choices and economic trends. IFPI is pleased to partner again with Larry DeBoer, sharing vital insights from one of Indiana’s foremost experts on state and local tax policy. 2019Data Spotlight: Percent of Total K-12 Compensation to TeachersAnalysis with Indiana Business CenterAs students across Indiana settle into the 2019-20 school year, the task of increasing pay for Hoosier teachers still has to be graded “incomplete.” While the 2020-21 budget includes significant increases to K-12 education funding, Indiana is still pursuing longer-term strategy for translating state support into competitive salaries. Education is a labor-intensive endeavor: Roughly 80% of a typical school corporation’s operating budget is spent on personnel – salaries and benefits for teachers, administrators and support staff. To shed new light on spending priorities and teacher pay, the Indiana Fiscal Policy Institute worked with the Indiana Business Research Center to find the percentage of total K-12 labor costs going to the compensation of full-time, classroom teachers versus other staff. Indiana's FY2019 Review: Surging Revenue, Surging SurplusThe end of June marked the end of Indiana’s fiscal year, and after crunching the final revenue data and totaling up expenses, reversions and other adjustments, the state released its 2019 close-out report on July 12th – by the books, as Hoosiers have come to expect. The major news coming out of the announcement from Auditor of State Tera Klutz and incoming Office of Management & Budget director Cris Johnston is better-than-expected revenue growth pushing the state surplus to historic levels. 2019 General Assembly: 'Paycheck Priorities'The 2019 General Assembly crossed the finish line this week, dropping the gavel on nearly five months of work, more than a thousand introduced bills and a single constitutional duty: Passing a biennial state budget for 2020 and 2021. This session featured a number of contentious issues: Lawmakers rolled the dice on sports wagering and dealt a new hand to the casino operators. They played referee among downtown Indianapolis hoteliers and hospitality interests. They added high-tech tools to the state’s economic development arsenal and labored to fashion a compromise on bias crimes as an economic and criminal justice imperative. But the legacy of a budget year is usually embedded within HB1001 – and 2019 put teacher compensation atop the legislative priority list. And while education advocates rallied for higher pay, the latest state revenue reports offer a reminder that personal income growth for all Hoosiers remains perhaps our most daunting long term economic – and fiscal – challenge. A Fiscal History of Indiana Local GovernmentIFPI Report by Craig Johnson & Justin Ross |

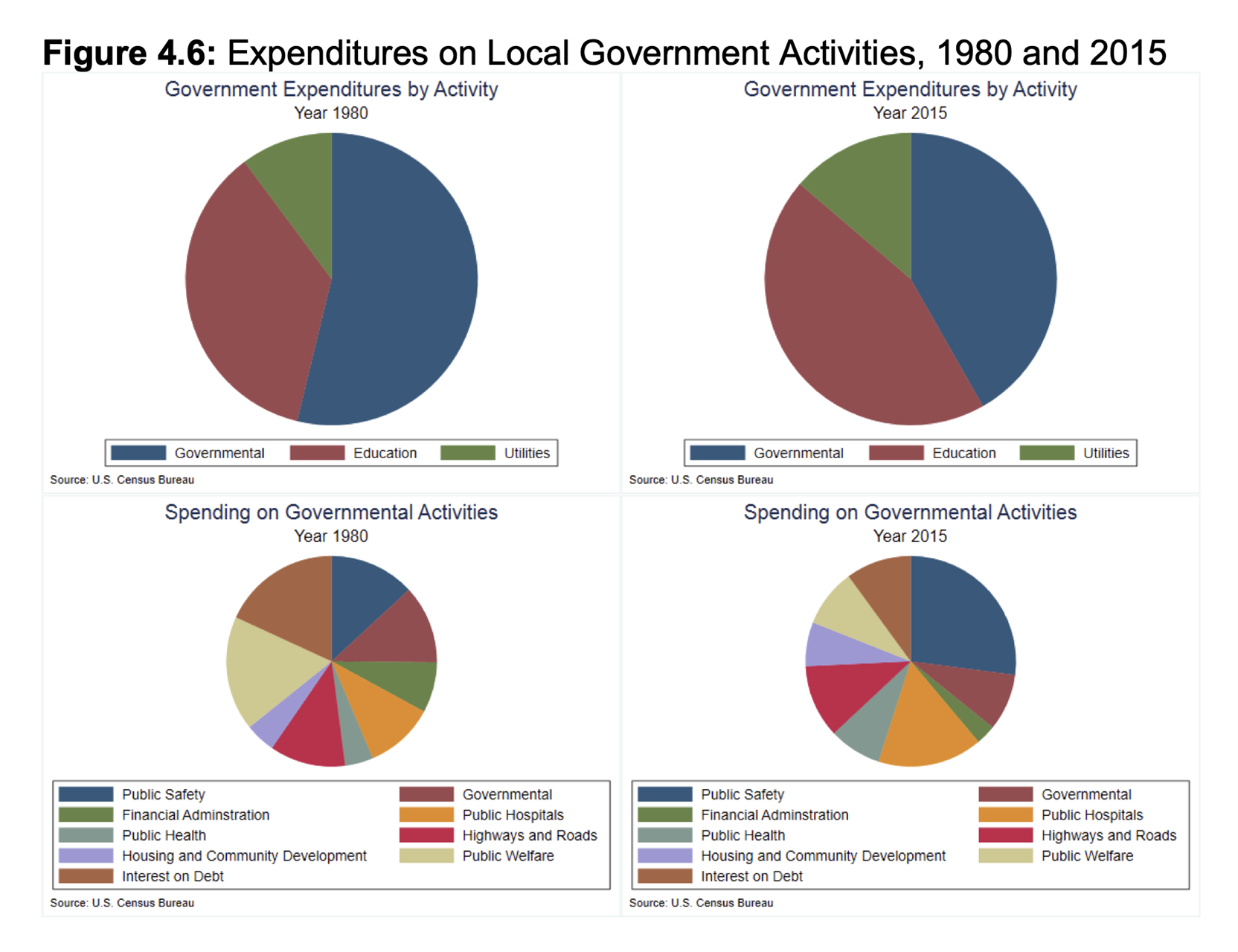

Over the last 40 years the fiscal structure of Indiana’s local governmental units has showed remarkable consistency up until the early 2000’s. On the revenue side much of the recent changes are fully consistent with the foundation laid by the Bowen tax package in 1973 - property tax relief; an expansion of local government authority to generate revenue from local income taxes; and an increase in the state sales tax to fund local services, programs and provide additional property tax relief. A structural shift in real own-source local government revenue began in 2004, as shown in Figure ES.1. Local income tax revenues took off and did not stop increasing until 2010. |

2017

IFPI Session Reports

Report #1 Shifting Sales Tax on Gasoline Without New Revenue Leaves Less for Roads and Nothing for Education, Other Programs | Report #2 Budgets and Transportation Bill Show Republican Fiscal Priorities Differ Between Governor, House and Senate |

Report #3 Indiana's Regional Cities Program at a Crossroads

| Report #4 Sales Tax Increment Financing in Indiana: Putting HB1144 into Historical Perspective |

Indiana's Revenue Forecast and Budget Comparison

Indiana’s gradually improving economy is expected to produce about $201.2 million more in tax revenue than previously forecast in December 2016. It’s a relatively small uptick in a two-year budget that will spend more than $30 billion.

Most of the growth is expected to come from individual income tax, thanks to expected higher wages. Income taxes are expected to generate about $119.2 million more than previously forecast.

Confidence is higher in the forecast thanks to changes made in December to models for sales taxes. The models are better able to account for sales tax receipts on gasoline. Reductions in the price over the last two years meant the forecast significantly missed its mark through December.

While the forecast was generally optimistic, the economic forecast again came with a caveat that changes in federal policy regarding trade and taxes could have a significant effect on the actual outcome.

Revenue Forecasting: Indiana's Method and the Results It Produces

The time for Indiana to approve its biennial budget is fast approaching. State law requires the General Assembly to pass an agreed upon version of House Bill 1001 by April 29, 2017. Indiana’s revenue forecast, expected to be released April 12, will be used to guide the final stages of budget preparation. Recent trends in tax revenue collected in Indiana have been forecasted with a fairly high level of accuracy from year to year. Forecasts over the last 10+ years, both high and low, were within an average difference of less than 3 percent of the actual revenue collected – including the years affected by the Great Recession. Individual income tax and sales and use tax, which account for more than 80 percent of the state’s tax revenue, are the two most influential on tax revenue trends; and total revenue collected reflects their steady overall increases. While not perfect, Indiana’s forecasting process helps to preserve a high level of accuracy to inform the Legislature.

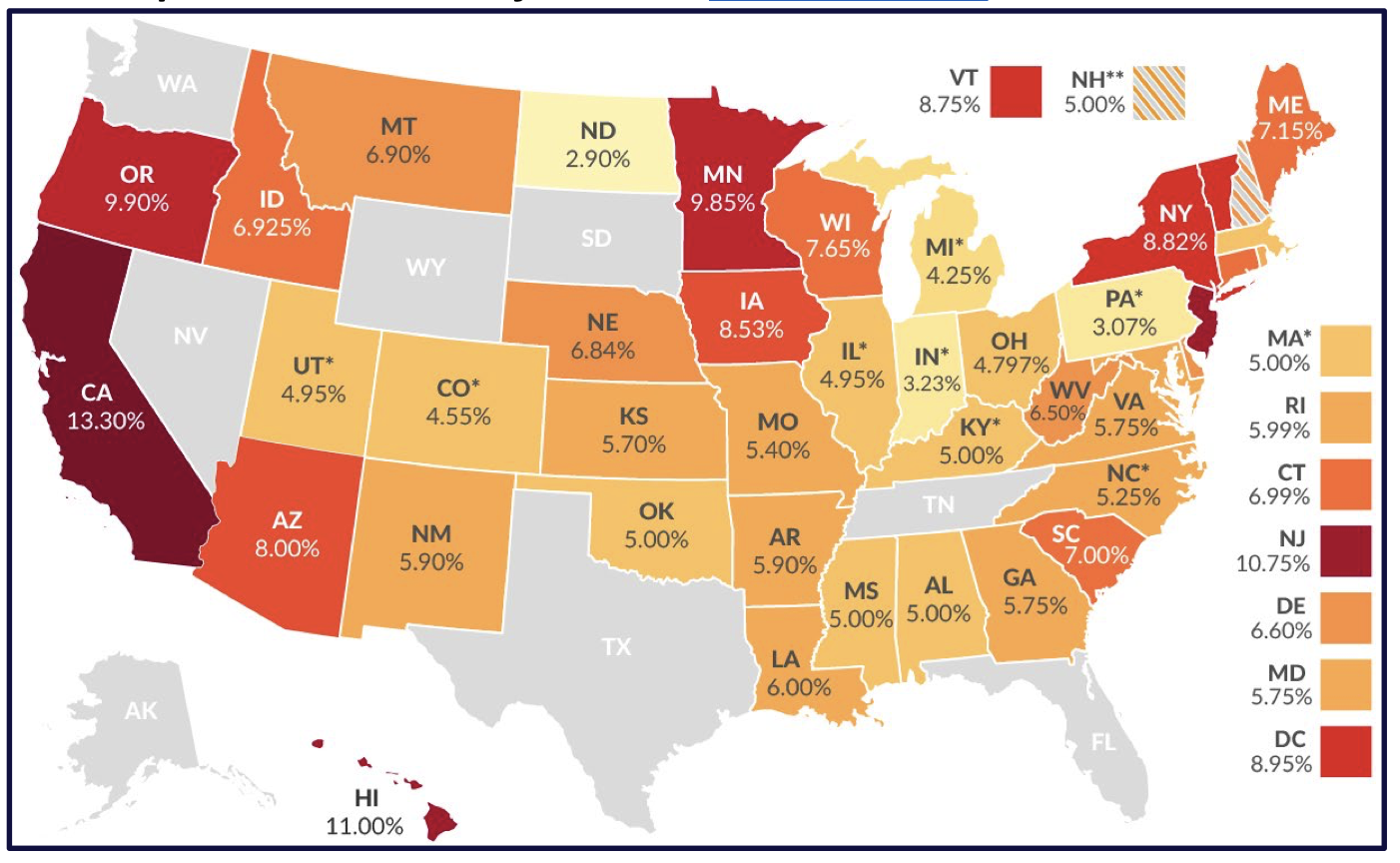

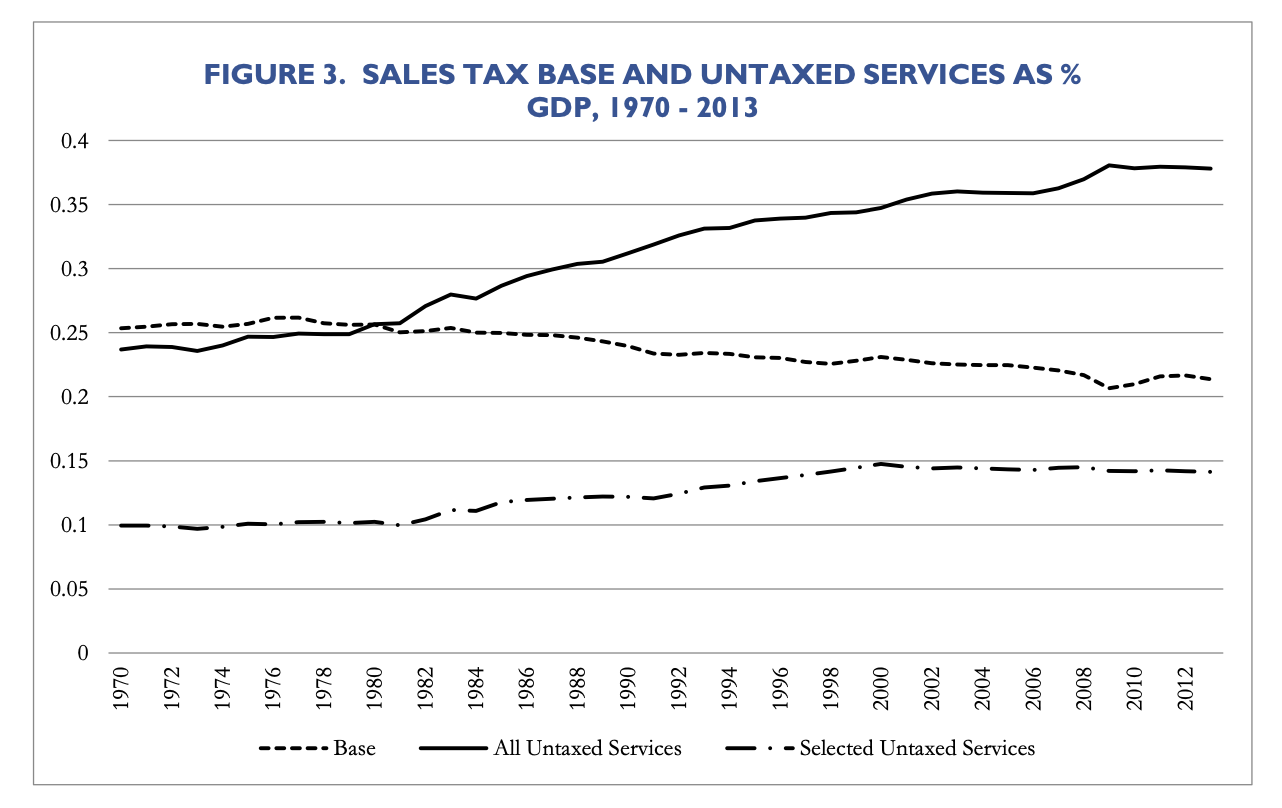

Considering Sales Taxation of Services in Indiana

The history of the Indiana retail sales tax begins in 1963 when the state legislature amended the 1933 gross income tax law that had been enacted as a Depression-era revenue producer, splitting that tax into separate sales and use tax and individual income taxes.1 This precursor tax was a tax unique to Indiana that encompassed a broad business gross receipts tax with an individual gross income tax.2 Dividing the tax into standard retail sales and individual net income taxes was a considerable reform of the state revenue system. The new sales tax primarily taxed purchases of goods, as most other state retail sales taxes did then and continue to do now. It was not a luxury tax or a punitive tax or a tax designed to pay for only particular government services. Rather it was a broad tax for support of general services provided by the state. That is the tax that continues today. |

Indiana's Public Pensions

When it comes to understanding the fiscal health of state pension funds, the popular measure is the unfunded liability. Yet there are many other measures that provide a more complete look at the health of state pensions and how it affects those who depend on the benefits—and the taxpayers who foot the bill. This report provides a more detailed look into Indiana’s public pension plans through the two largest—the Teacher’s Retirement Fund and the Public Employees Retirement Fund. What we find is a well-funded PERF and an improving TRF, but significant challenges that remain, especially for local governments and school corporations as the share they’re asked to pay has grown.

2016 |

Funding Indiana's Roads for A Stronger, Safer Tomorrow

The Task Force believes Indiana’s road transportation system is underfunded, there is an immediate need to upgrade the interstate, state and local roads/bridges and that it will require increases in taxes and other user-related fees to pay for the improvements. Several members of the Task Force estimated the need for new funding is about $1 billion per year.

IFPI Revenue Forecast - December

Indiana’s tax revenue is expected to be significantly less ($300 million) than what was forecast a year ago, dampening the outlook for new spending in the next two-year budget lawmakers will begin formulating in January.

The culprits: lower-than-expected gasoline prices and corporate income tax collections.

The revenue forecast committee made changes to the formulas for the sales tax on gasoline, which they expect will yield more reliable predictions. A revised forecast is due in April that lawmakers will use as they complete their budget deliberations.

One caveat: the forecasting process was complicated by the presidential election this year since it is unclear how the incoming Trump administration will affect federal policies or how quickly it will act.

Three things marked the closeout of Indiana’s budget for Fiscal Year 2016 on July 25. First, the closeout was about 10 days later than usual. Typically the state’s closeout is announced during the second week in July. This year, however, was not typical. Gov. Mike Pence’s selection as candidate for vice president on the Republican ticket broke in the news on July 14, the same day the closeout was conducted in 2015. Between his selection as the candidate and the subsequent Republican convention, it’s no surprise the closeout was delayed. Second, the governor did not participate in the public release for the first time in recent memory. The lieutenant governor and the auditor conducted the press conference in conjunction with the release of the revenue report, surplus statements and reversion summaries. Finally, while the reports showed again that Indiana is well managed from a financial standpoint—a hallmark of nearly all administrations over the last several decades—there is some cause for concern in the revenue report. For the second time in three years overall tax collections lagged both the Budget Committee’s projections and the previous year’s results. While it’s not unusual for tax revenue to be below projections, it is unusual for actual collections to fall year- over-year. That this occurred at a time of economic expansion and low unemployment adds to the concern. |

|

The Fiscal Health of Indiana's Larger Municipalities: City Reports |

2015 |

What Do We Know About Indiana's Property Tax Caps?Indiana’s circuit breaker tax caps were a product of the 2008 property tax reform. The Fiscal Health of Indiana's Larger MunicipalitiesThe municipal governments in Indiana’s larger cities have been financially impacted by the combination of the Great Recession and the property tax caps enacted in 2008. To what degree has the impact impaired the fiscal health of these local governments? This study examines a variety of municipal financial indicators in an attempt to address this question. |

|

2014 |

The Personal Property Tax in IndianaIt could be said the Indiana General Assembly has been working to eliminate the business personal property tax since 1966, the year Hoosiers approved a constitutional amendment that allowed lawmakers to separate taxation on real and personal property. Since then personal property taxes have been eliminated on intangible property like stocks and bonds, household goods such as furniture, on vehicles including cars and planes and boats, and, most recently, on inventory. The only remaining category of personal property taxed by the state: business personal property. | |||

| |||

| |||

|